The Future Office: Finding The Balance

2024 feels like a genuine turning point for property markets in the face of financial, political, and behavioural change. Many global markets remain destabilized by a weak economic outlook, amplified by geopolitical tensions. Yet, the year brings a cautious sense of optimism for property investors, developers, and occupiers, as we finally anticipate a progressive recovery and a more open road ahead.

ESG (environmental, social, and governance) is now a prominent consideration in decision-making, and the S (Social) of ESG is coming into sharper focus. Social impact in real estate is a multifaceted concept. It could mean delivering multi-use community spaces within new urban developments, and investors and occupiers increasingly favour buildings that promise positive social impact as well as environmental resilience.

CITIES FIGHT BACK

With these factors in play, cities will continue their post-pandemic fightback. In 2024, we expect an acceleration of efforts to provide healthier, greener, and more inclusive urban environments, drawing businesses and residents back into the heart of cities.

We already see that trend in office markets, where the current flight to prime is a shift towards more sustainable, flexible, and multi-faceted buildings. At the same time, we think keener pricing and falling interest rates will encourage more businesses to consider upgrading or expanding their office footprints this year. That will be especially true in cities and industries that can make the most of the continuing AI revolution.

The structural shift we’ve seen in the office market in recent years is not simply the result of pandemic-enforced work-from-home policies. It also reflects a broader recalibration of workforce priorities and lifestyles—alongside pressing environmental, social, and governance (ESG) concerns.

Much of the world’s existing office stock needs to adapt to meet the evolving needs of businesses, individuals, and cities—so owners have decisions to make. Those confident in the appeal of their well-located stock will still need to innovate to appeal to workers. At the other end of the spectrum, some will need to give their space a second life and repurpose to optimize value.

Woven through both these options is a strong need to meet high environmental standards—both to remain relevant with occupiers and meet growing regulatory requirements—at a time when economic viability is challenged.

GLOBAL DIFFERENCES

Although the debate about the changing office market is global, its impact is anything but uniform. Cultural differences, housing costs, commuting expenses, and social norms influence a dynamic landscape across Europe, Asia, and the Americas.

Asia has the highest office occupancy rates, at an average of 88%, followed by Europe. The US lags, with cities such as San Francisco and Los Angeles still below 50% occupancy. Employees simply do not want to work 40-hour office weeks. Even Elon Musk is threatening employees with the sack at Twitter if they do not come to the office.

Simon Raper, Savills Head of Workplace Strategy for APAC and Singapore, says: “Even within the same organization, there’s a need for flexibility as cultural nuances necessitate adjustments from country to country. Understanding these differences is crucial for corporations—particularly as some contemplate relocating to meet changing workplace design requirements; environmental upgrades due to more stringent regulation; or employment demands driven by economic recovery.”

In Europe, German and French employees have mainly stayed in the office as the cultural preference is for face-to-face interaction and collaboration—although younger generations are pushing for more flexibility. In contrast, in Sweden, innovative policies such as “no-meeting Fridays” acknowledge the importance of autonomy and flexibility in the workplace.

”EARN THE COMMUTE”

In the US, where attendance rates are the lowest globally, companies strive to “earn the commute” through amenity-rich offices and perks. Here, commuting time and house prices are key factors because many workers relocated to more affordable areas and larger houses during the pandemic.

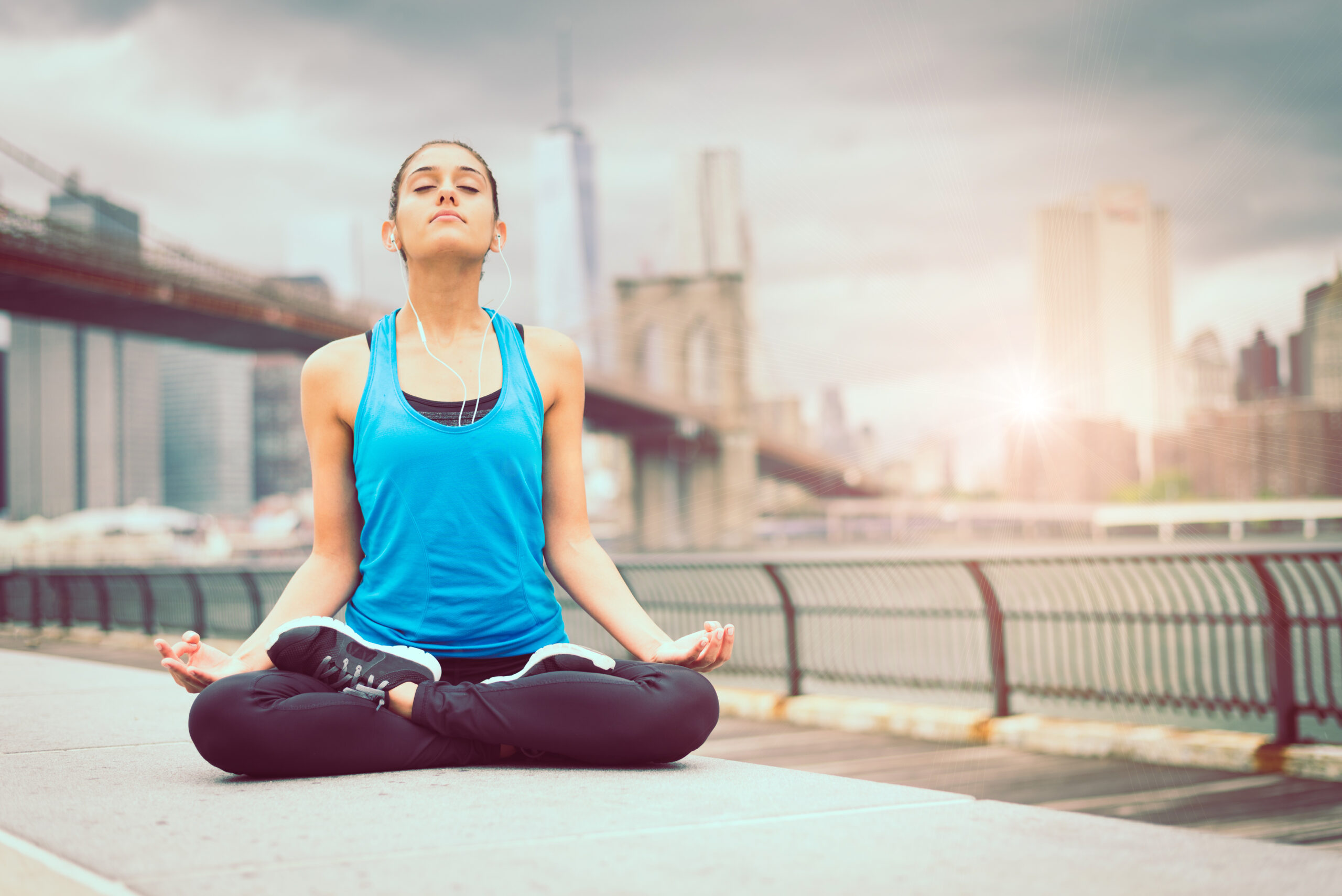

To be successful in this environment, companies need their offices to act as a magnet to attract and retain talent. Creating spaces that resonate with employees’ needs is a strategic imperative. Younger generations of workers prioritize wellness, professional development, and meaningful experiences—all these need to be present if they are expected to turn up to the office regularly.

Companies that design workspaces prioritizing flexibility, a human scale, and a sense of community can expect to see improvements in recruitment, retention, productivity, and overall purpose. Many companies, including Savills, are already adopting and promoting these trends (see box).

ESCAPE TO THE COUNTRY

In Portugal, the countryside surroundings of the Quinta da Fronte office park are now more of a selling point than when it was established in 1995. Its ecosystem provides an amenity-rich environment that prioritizes work-life balance. This includes seven restaurants, plus a gym, spa, and healthcare facilities. The office park promotes a thriving community by encouraging neighbouring companies to mix.

In the US, investment manager Jamestown is using a combination of tech-enabled common space, hospitality-style amenities, and creative placemaking to develop enriching workplaces. At Raleigh Iron Works in North Carolina, the renovation of historic steel mills and warehouses means office workers are part of an innovation hub and community centre with a wide mix of uses, including shopping, dining, and living space.

This need for workplaces to change has led to a wave of office refurbishments across most major economies. With growing concerns about climate change, refurbishments must meet environmental regulations if they are to satisfy the growing demand from occupiers for high-quality, sustainable space.

In London’s West End, the refurbishment rate as a share of development space in the pipeline is expected to increase from 35% (10-year pre-pandemic average) to 43% (five-year average, 2023-2027).

TIRED, HALF-EMPTY OFFICES CAN BE TRANSFORMED INTO MORE DYNAMIC, ENERGETIC USES THAT DRIVE FOOTFALL.

In current market conditions, the need to invest capital expenditure into existing stock is challenging. This is more pronounced in European markets, where stock is often older—although in most locations, the definition of “prime” has narrowed to such an extent that a large proportion of younger office stock also needs upgrading to meet future environmental standards.

James Evans, Savills UK National Head of Office Agency, says: “Businesses are driven by how they can attract the best people. Today, that’s in the top-grade building but not the second-grade one—so what to do with that building?

That’s a challenge for the existing landlord—but it can be exciting. We’re seeing some interesting alternative uses popping up in city centres, particularly around the education sector and hotels. Part of the wider locations can be transformed into more dynamic, energetic uses that will drive footfall.”

PUBLIC-SECTOR SUPPORT

Any successful transition of office stock into a wider range of uses requires public-sector support. Governments, city administrations, policymakers, and planners will play a pivotal role in shaping the future of workspaces—through incentives, changing land usage, and supporting sustainable urban environments. Developers can also be encouraged to rethink ageing office stock.

Meanwhile, in Singapore, the government is driving change through its Green Plan 2030, a long-term roadmap to make the city’s building stock more sustainable. The flight to new, more sustainable buildings has led to rising vacancy rates in older Central Business District (CBD) buildings. The government has grants for green upgrades for buildings, as well as planning incentives for floor area intensification. This has the added benefit of bringing a mix of uses to enliven the CBD on weekends and after office hours.

Alan Cheong, Executive Director of Research and Consultancy at Savills Singapore, says: “Whether it’s the greening of older buildings or the repurposing of offices, the role of the government is key in achieving those aims. Singapore has offered incentives to certain areas with the hope that older buildings in those locations may get repurposed or redeveloped to mixed uses, thereby injecting more vibrancy into the CBD on both weekends and in the evenings.”

This kind of future-proof thinking needs to be applied to workspaces worldwide to meet the evolving needs of employers, their staff, and the cities in which they work.

With thanks to Savills. Read their full 2024 global impacts report covering all market segments at www.savills.com.