Universal Capital Bank and Visa Introduce Montenegro’s First Platinum Business Metal Card: a Blend of Luxury, Exclusivity, and Social Responsibility

INTERVIEW WITH MILOŠ PAVLOVIĆ, PRESIDENT OF THE MANAGEMENT BOARD AT UNIVERSAL CAPITAL BANK

Thanks to you, Universal Capital Bank stood out this year in the prestigious annual selection of the Association of Montenegrin Managers, held under the patronage of the Government of Montenegro, which awarded you Manager of the Year in the category of joint stock companies. How do you comment on your achievements? Has your vision remained the same from the start and what is your success strategy?

Every award represents added motivation, especially when it comes from fellow managers from some of the largest and most successful companies in Montenegro. I see the Manager of the Year award for 2023 in joint stock companies from the Association of Montenegrin Managers as recognition for creating an extraordinary team in Universal Capital Bank and for the record results our team achieved in the previous year.

The strategic direction that enabled us to achieve these recognised results was actually absolute dedication to the client. This is our business mission. In keeping with the vision of the corporate group we belong to, we offer bespoke products and services to meet the individual needs of each of our clients. We like to say that we have as many products as clients, because we are indeed dedicated to each of them and we tailor our services to all their requirements. Such an approach, both towards our clients as well as towards all of our partners, enabled us to build almost unbreakable ties with them all, and whose satisfaction is our best publicity. The success we achieved is simply a vital consequence of our approach.

How would you describe past business year and what results did UCB have at the end of year 2023?

Last year we achieved record results in almost all segments of business. Historic profit was made, all business parameters are at a record level; we have significantly improved employee satisfaction and we are perhaps most satisfied with our team. UCB was the first to introduce three new products on market (biometric identification, direct payment operations with Serbia and Bosnia-Herzegovina, and Visa Business Metal Card) and it invested big efforts to contribute to the community through our ESG strategy.

Universal Capital Bank is recognised as a socially responsible company. How much importance do you attach to CSR in the context of your operation?

Corporate social responsibility has been a strategic goal and premise since the opening of Universal Capital Bank, under which projects focused on community support are implemented. This business practice has a direct positive influence on employees and work conditions, the local community and the environment. That is why each year the Bank allocates significant funds for various activities, sponsorships and donations, aimed at the most sensitive social groups. I would like to point out that in addition to social responsibility, we focused on the implementation and activation of already well-known ESG (Environmental Social Governance) standards, that is, on a sustainable way of doing business at all levels and in all segments.

You were the first in Montenegro to introduce a direct payment transaction service with the Republic of Serbia and Bosnia-Herzegovina. What are the benefits of Clearing? Is there significant client interest in this type of service?

We are very proud of the fact that we were the first in Montenegro to provide our population and the economy with direct payment transactions with Serbia and Bosnia-Herzegovina. For almost 18 years, there was no direct payment operation with these two neighbouring countries, with which Montenegro has the largest number of payment transactions. This meant that funds to the banks in Serbia and Bosnia-Herzegovina went through other correspondent banks in Europe, which increased the costs of these transactions but also extended their execution time. UCB’s strategic commitment is to put the client first. And it’s not just a phrase. We truly nurture a culture of dedicated care for the needs of our clients, and when we identify a need among our clients for a cheaper, faster and more reliable service enabled by direct payment, we provide it to our clients regardless of how much work and investment it requires.

Interest among our clients exceeded all our expectations. Payment transactions with Serbia and Bosnia-Herzegovina increased by over 50% yearon-year, and the growth continues. Every day we get new clients thanks to this service.

I would say that the biggest advantage of direct payments in retail is transaction costs, which are now three times lower. Namely, with the establishment of direct payment operations, a client sending EUR 100 to one of these two countries now pays a EUR 5 fee instead of EUR 15, which is what this transfer cost before. Meanwhile, corporate clients see the biggest advantage in this system in the time required for transactions to be carried out and their reliability, as well as, of course, in the low costs. Funds sent to Serbia or Bosnia-Herzegovina, or from those countries to Montenegro, will be in the recipient’s account on the same day they were sent, without exception. Until now, this was most often not the case and it often happened that funds did not reach the recipient’s account for several days, which slowed the flow of goods and services.

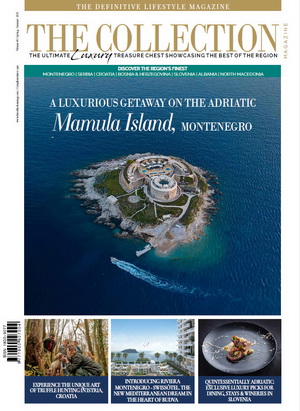

When it comes to innovations in the Montenegrin market, it can be said that you are constantly bringing in world trends in terms of payment cards. This time, it’s an absolute novelty in the banking sector of Montenegro – the first payment card made of metal. What was your inspiration for developing this type of product and what are its advantages?

Keeping pace with world trends in the payment card industry, Universal Capital Bank, in cooperation with the Visa company, a global leader in the field of digital payments, launched the first and unique Visa Platinum Business Metal Card in the Montenegrin market. In addition to its extremely luxurious and innovative design, this payment card offers exclusive benefits solely to its cardholders.

As I said earlier, our strategic commitment is to care for our clients and adapt our products to their needs. Considering out clients’ profiles, the introduction of the metal card was a logical next step. We believe that our clients deserve exclusively premium service in every respect, and therefore we strive to ensure that their bank can support their lifestyle.

I can say with certainty that the future path of the Bank will be directed towards the development and implementation of new technologies and the application of state-of-the-art solutions in business, but also affirming responsible social business, as evidenced by the fact that part of the membership fee of each issued metal card will be donated to charity objectives.

Contact Informationa

- A: Stanka Dragojevića bb, Podgorica, Montenegro

- T: +382 20 481 481

- E: info@ucbank.me

- W: ucbank.me