World Real Estate Markets – Demand, Supply and Stability

Not just in our region, but 2022 was a year of (un)predictable political events, of an(un)anticipated economic slowdown, of (un)expected surging inflation, of what seems (un) stoppable warming weather, and for real estate, the turning point of a cycle. 2022 was characterised by a progressive declining flow of capital in real estate and softening yields, notably due to surges in both interest rate and debt cost.

Hotspots in the region such as Belgrade, Boka Bay and Dubrovnik are expected to continue to prosper even with rising building costs and uncertainty. Other markets, where supply had tried to catch up with the now dwindling demand, such as major markets in Zagreb, Budva etc. may well struggle in 2023 with prices coming under pressure in a changing marketplace.

Kieran Kelleher, Owner, Savills Croatia & Montenegro

Clairvoyant rather than scientific skills would be more useful now to try to predict the 2nd half of 2023. With the announcement in the last week of concerns around bank liquidity forcing the closure of Credit Suisse and rumours of concerns within Deutsche Bank, this may well trigger a move from cash to bricks and mortar. But many other factors are at play.

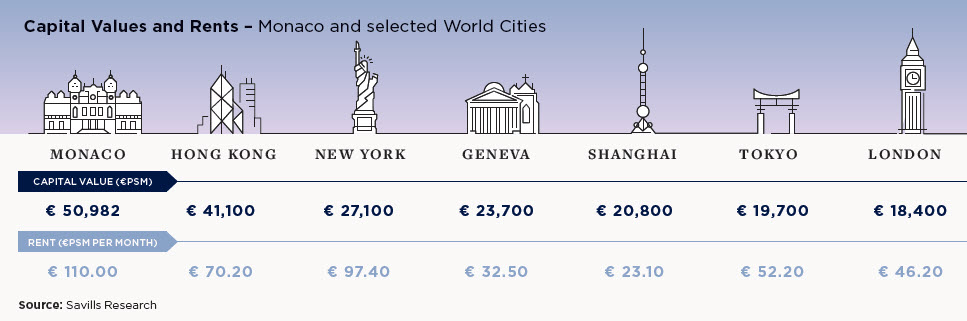

In this edition of The Collection, we look at one market which seems to weather all storms – Monaco. We also present pricing and rentals in other major world cities, which shows clearly that there is still significant confidence in the real estate market around the world.

With thanks to our colleagues at Savills Monaco, we are delighted to present their latest market spotlight which makes remarkable reading.

For any assistance in Monaco, please contact:

Fraser Richardson

Savills Monaco

Mobile: +33 6 80 86 29 88

Office: +377 97 70 42 00

Email: [email protected]

Website: www.savills.mc

RESIDENTIAL MARKET

Market overview

A record-breaking year for residential property unaffected by global uncertainty

Courtesy of Fraser Richardson

While many markets began to struggle in the second half of 2022, Monaco real estate experienced a bumper year. Over the year, there were 520 transactions across the Principality, which while lower than the highs seen between 2014 and 2016, is 10% above transaction volumes seen in the past five years.

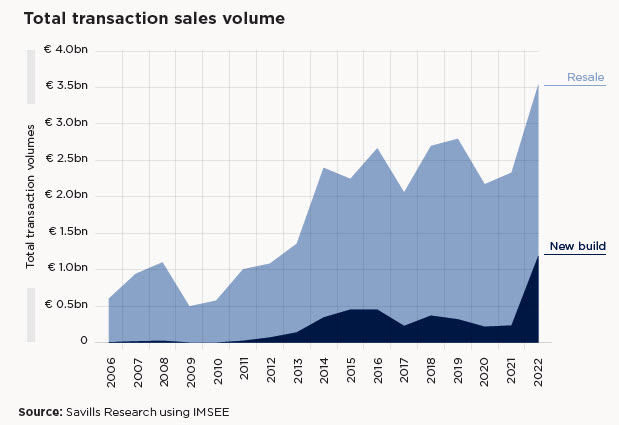

After a record-breaking year for pricing in 2021, where prices surged past the €50,000 per square metre barrier, 2022 saw the smashing of another record. For the first time, total transaction volume came to €3.5bn for the year, nearly three-quarters of a billion euros higher than the previous record, set in 2019.

Courtesy of Fraser Richardson

Needing the new

This record transaction volume has largely been driven by the new-build market, which also achieved record high sales volumes. New build sales crossed the €1bn threshold for the first time in 2022, precipitated by a large number of properties coming to market; 146 in 2022, which was the third highest number of deliveries ever behind 1993 and 2015. The 88 new build sales that Monaco achieved in 2022 were driven both by the high number of flats coming to market and also by the ongoing construction projects which have led to increased off-plan sales, and represented a nearly 300% increase over 2021 figures. New builds accounted for a record 34% of total sales in Monaco during 2022, an exceptional figure given the average share of new build sales has been approximately 8% of the total since 2006.

The race for space continues in Monaco, both as a result of the pandemic causing global reassessment of housing needs, and because of a change in approach to residence card applications in recent years, meaning greater scrutiny of the size of properties rented or bought by prospective residents. This change has been filtering through the new build market, with many new build schemes offering larger apartments. As a result, the sales of apartments with three bedrooms or more increased by over €830 million in 2022 compared to the previous year and accounted for over 80% of the new build sales across the Principality.

Resale rebound

The number of resales in Monaco has returned to pre-pandemic levels. This rebound has largely been driven by the increase in sales of larger apartments, with two-bedroom or larger property sales increasing by 12% from 2021. Two-bedroom properties in particular saw the largest increase in sales with 103 properties transacting, an increase of 18% from the previous year.

The total volume of resales for the year totalled €2.35bn, with 432 properties changing hands. Two-thirds of these properties were priced below the €5m mark; however, increasing numbers of sales at the top end of the market are helping to support rising total sales volumes. The number of properties sold with prices above €10m has increased by over 50% in a year and 300% over the past decade.

Buyers in Monaco tend to be in the 40-60 age bracket and have school-age children. These buyers are also largely still active in business and view Monaco as an economically efficient and safe place for their families. They come from across the globe, but many buyers are British, Italian, Belgian, Scandinavian, and South African. In recent years, there has been an increase of younger buyers, many from the finance and tech sectors who want a European base.

It isn’t just being in Monaco that attracts these buyers and residents – many are looking for properties within specific districts or developments within the Principality. Properties sold in the Monte Carlo and La Rousse districts accounted for nearly two thirds of the total sales within Monaco and just over €1bn of the total second-hand sales volume for the year. Larvotto took the top spot for most expensive district by square metre in 2022, with prices rising 4% on the year to €62,000psm; however for a district with so few properties changing hands each year (only five properties sold in 2022 and an average of four properties sell each year), any high price-point transaction has the potential to skew the average price per square metre for the district.

Courtesy of Fraser Richardson

If you build it, they will come

For decades, the prevailing story of the Monaco property market has been one of chronic undersupply. For a microstate less than half the size of Central Park in New York City, this is hardly surprising.

To try to meet the consistently high levels of demand, construction projects continue apace. There are two large projects in the pipeline: Mareterra, Bay House Monaco, and other smaller projects such as Le Luciana, and the second phase of Villa Portofino. The most ambitious of these developments, Mareterra, will add 110 apartments, ten villas, a new port, and a public park, along with other infrastructure, all built on land reclaimed from the sea. Each of these projects will bring much-needed stock to the Principality but will do little to keep up with the consistently high demand across Monaco.

For many prospective buyers globally, the mood for the coming year is decidedly more downbeat than it has been in the previous two years since the pandemic. In the recent Savills Global Agent Sentiment survey, agents reported that there has been a shift in buyer sentiment towards one of caution. Many local agents stated that they are stressing the value of property as a long-term investment along with the potential for future growth after this period of uncertainty. This caution globally has the potential to further boost Monaco’s property markets as many buyers will be looking for property as a hedge against inflation, global uncertainty, and other more volatile markets, which Monaco can provide in large measures.

Courtesy of Fraser Richardson

Outlook

A steady ship in stormy seas

With demand outstripping supply across the Principality, it is likely that 2023 will see similar levels of sales and pricing to 2022. In a market such as Monaco, where purchasers are much less reliant on bank financing, the role of interest rates will likely have less of an impact on sales volumes than in other locations. As the volume of sales transactions also strongly depends on domestic purchasers, we expect sales volumes to remain strong with stable prices.

As with the rental sector in other prime residential markets, it is likely that the Monaco rentals market will see another strong year in 2023 as a result of increasing numbers of residents flocking to the Principality in search of quality of life, safe havens from global economic turbulence, and the fact that the sales and resale markets in Monaco are undersupplied. So many new residents will choose to rent before they purchase flats, further supporting rental market performance.

Savills Research

We’re a dedicated team with an unrivalled reputation for producing well-informed and accurate analysis, research and commentary across all sectors of global property.

World Research

Kelcie Sellers, Associate

[email protected]

+44 (0)20 3618 3524

Global Residential

Jelena Cvjetkovic, Director

[email protected]

+44 (0) 20 7016 3754

Monaco Residential

Irene Luke, Partner

[email protected]

+377 97 70 42 00

Jean-Claude Caputo, Partner

[email protected]

+377 97 70 42 00